Delinquent Accounts

A basic penalty of ten percent (10%) of any delinquent amount will be charged on any amount remaining unpaid twenty-five (25) days from the billing date, plus one percent (1%) per month for charges that remain unpaid. Postmarks are not accepted.

For accounts where the utilities are billed to the property owner, delinquent balances may result in the recording of a lien against the property where service is provided and an assessment on the San Joaquin County Tax Roll.

Contesting a Utility Bill:

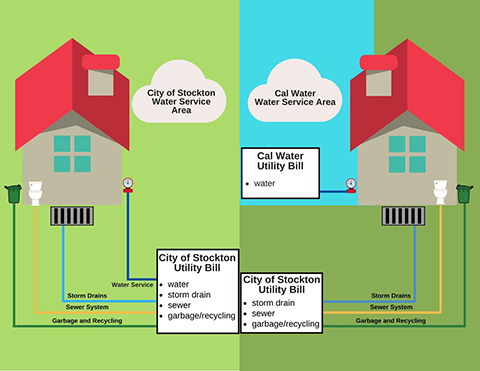

City’s Water Service Area

In the City’s water service area, customers receive a unified bill for water, storm drain and sewer.

Cal Water Service Area

In Cal Water’s service area, customers receive a water bill from Calwater and a separate bill from the City of Stockton for storm drain, sewer, and garbage and recycling. When the City of Stockton bill is unpaid, water service cannot be shut off because the City is not the water service provider.

Liens and Assessments

Effective in 2018, unpaid accounts billed to the property owner may result in the recording of a lien on the property. If the lien is not cleared and the amount is left unpaid, the City may collect by assessment of charges transferred to the San Joaquin County Tax Roll and collected through the property tax bill.

Notices Sent to Property Owners/Utility Account Holders

"Notices of Intent to Record a Lien" are sent throughout the year and "Notices of Charges to Be Assessed" are sent to the billing address and the owner of record mailing address listed on the San Joaquin County Assessor’s property records.

Liens

Property owners who receive a Notice of Intent to Lien may appeal by requesting an Administrative Hearing within 10 days of the date of mailing and by paying the Administrative Hearing Fee of $102 at City Hall, as established in the City’s Fee Schedule.

- Property owners may avoid the recording of a lien by paying the balance owed within 30 days of the lien notice mailing.

- If the property owner does not pay the amount in-full or comply with the terms established by the Administrative Hearing Officer, the lien will be filed.

Assessments

Liens not cleared will be considered for an assessment. Administrative hearing are held in June for assessments. The Administrative Hearing Officer will not address the validity of the charges and the amounts due. The purpose of these hearings is to confirm whether the charges should be added to the property tax roll report for the City Council's consideration.

Assessments Transferred to Tax Roll

In July, the City Council holds a Public Hearing to approve the written report of assessments and to authorize the amounts owed to be assessed on the owner's property tax bill. The assessed charges are sent to the San Joaquin County Treasurer-Tax Collector for collection on the tax roll.

Delinquent Account Inquiries

To determine if a delinquent balance is being considered for lien or assessment, property owners may contact City of Stockton Utility Billing at (209) 937-8295.

External Links

There are currently no external links.

This City of Stockton web page last reviewed on --- 7/13/2023